- Home

-

Who we help

- UK Business & Entrepreneurs

- UK Companies expanding globally

- International groups expanding into the UK

- Charities

- Creative Industries

- Fashion & Beauty

- Family Businesses

- Globally Wealthy Individuals

- Individuals & Families

- Leisure & Hospitality

- Private Finance Initiative

- Professional Practices

- Property & Construction

- Property Developers

- Property Investors

- Social Businesses

- Student Unions

-

Services

- Audit

- Benchmarking

- Business Advice

- Business Performance Improvement

- Business Tax

-

Personal Tax Planning

- Domicile & Residence Planning

- Expert Witness for Matrimonial Disputes

- Family Investment Company

- Inheritance Tax Planning

- Internationally Mobile Individuals

- Personal Tax Investigations

- Retirement Planning

- Offshore Structuring

- Succession Planning

- Self Assessment Tax Return Service

- Tax on Residential Property

- Trusts

- Support & Accounting

- About

- Insights

- Careers

- Contact

- Search

-

Who we help

Who we help

We help organisations and their owners and directors.

The organisations are UK based as well as international groups looking to invest into the UK. They tend to be established and growing entities.

We love working with clients across a broad range of sectors but have particular expertise in the areas listed.

We also work with private individuals and families with their own personal tax matters, whether their wealth is UK-based or international.

-

Services

Our services

Goodman Jones are not just Chartered Accountants and Auditors – but advisers who are passionate about providing an outstanding tailored service to each of our clients.

Our range of services are our response to listening to what our clients value.

-

About

About us

We are not just Chartered Accountants and Auditors – but business advisers who are passionate about providing an outstanding tailored service to each of our clients.

-

Insights

Our Insights

We share insights regularly on issues and topics that affect our clients. Find out what our people think...

Audit for charities

Compliance, insight, improvement

We do not believe that an audit is a chore - it is far more than just a compliance exercise. An effective audit service is a continual improvement led by trusted experts with the specialist knowledge of the charity sector.

Charities face numerous and complex accounting and regulation requirements - even determining whether an audit is under the Companies Act or the Charities Act, but always in accordance with International Standards on Auditing.

We take a systematic and risk-based approach to audits. Most importantly, we understand that every organisation is different – even if operating in the same industry or sector. Each entity has different drivers, objects, systems, methods of working etc. For us, it does not matter what sector a client operates in or how they do things - we take the time to really understand your organisation, get to know exactly how you work, and what ‘makes you tick’.

This deep understanding forms the core of our audit approach and drives the specific procedures that will be performed each audit.

Personal and pro-active approach

We believe that communication is key and that a strong relationship between client and professional adviser is fundamental to an efficient and effective audit.

We maintain regular contact with our clients during the year: getting to know you, understanding how you operate, and finding out the issues that important to you.

We bring these matters together in a pre-audit planning meeting with you, discussing those matters that are important to you, how we can help with these, and determining the audit information we require.

You will always have a dedicated team who you know and who know your organisation. Your charity specialist partner is responsible for all of your affairs, and your dedicated audit manager will co-ordinate the audit process and keep in contact during the work.

Adding value

Many audit firms only do what's required to comply with the necessary regulation. At Goodman Jones we go much further than just ticking the compliance box.

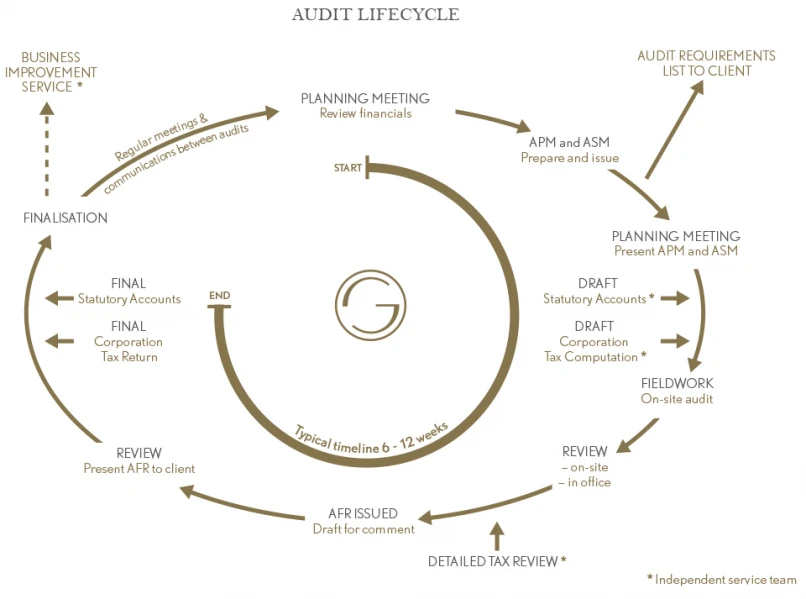

We've invested significant resources in developing high-quality products and technologies that underpin our audit lifecycle.

We issue you with a detailed Audit Findings Report - an invaluable document and one in which we certainly believe we add value to the audit process by providing you with bespoke advice and recommendations.

This report will include any points identified during our audit work. We grade the issues to give you an indication of the level of importance we consider appropriate to each issue. We make sensible, practical recommendations reflective of your circumstances.

However, we do not believe that the report should just be viewed as a negative document. It is also essential that you are aware of forthcoming changes that may have an impact upon your organisation going forward. This will allow you to plan pro-actively and efficiently for these changes.

Therefore, in our report, we will also draw your attention to any legal, accounting, or other developments where we feel your organisation would be impacted or would benefit. This may include changes to accounting standards, compliance requirements, new guidance introduced by the Charity Commission, draw on best practice elsewhere in the sector, or even bringing to your attention topical areas from the sector that may be of interest or provide ideas for your organisation.

How our audits work

1. Planning

- We start by creating two essential documents that form the basis for your audit:

- an Audit Strategy Memo (ASM), which lists what we’ll audit – and, importantly, what we don’t.

- an Audit Planning Matrix (APM) describes our detailed technical plan for the audit.

- Our audit team will then present these to you at a planning meeting before fieldwork starts.

2. Fieldwork

- Next we carry out the work set out in the ASM and APM at your premises. While doing so we amend the plan with any changes that emerge during the audit; and immediately communicate these to you.

3. Finalisation

- Our Audit Findings Report (AFR) sets out the results of our work, any issues we’ve found, and our recommendations for how to improve your business.

-

Who we help

- UK Business & Entrepreneurs

- UK Companies expanding globally

- International groups expanding into the UK

- Charities

- Creative Industries

- Fashion & Beauty

- Family Businesses

- Globally Wealthy Individuals

- Individuals & Families

- Leisure & Hospitality

- Private Finance Initiative

- Professional Practices

- Property & Construction

- Property Developers

- Property Investors

- Social Businesses

- Student Unions